All about Estate Planning Attorney

All about Estate Planning Attorney

Blog Article

Estate Planning Attorney for Beginners

Table of ContentsSome Of Estate Planning AttorneySome Known Facts About Estate Planning Attorney.Some Known Details About Estate Planning Attorney Estate Planning Attorney Fundamentals Explained

If you get lasting treatment or various other solutions with Medicaid, the Medicaid Healing program may seek repayment by claiming several of your estate, like your residence, after you pass away. A strong estate plan will safeguard your possessions and allow you to pass on as a lot of your estate as feasible.

It appears laborious however it's essential to talk with all your possibility legal representatives, considering that estate planning is a personal procedure. Will you send me updates on my estate plan in the future or is this an one-time solution? If you're working with an estate lawyer from a huge legislation firm, it's vital to understand if you will function solely with one person.

The Main Principles Of Estate Planning Attorney

Try to talk with people who have actually dealt with the lawyer, like their clients or perhaps another lawyer. Attorneys who are difficult to function with or who treat individuals inadequately will likely create such a track record rapidly with their peers. If necessary, have a follow-up discussion with your possible estate lawyer.

When it comes to ensuring your estate is planned and taken care of effectively, employing the best estate preparation lawyer is vital. It can be hazardous to make such a large decision, and it is very important to recognize what concerns to inquire when thinking about a law company to handle your estate preparing job.

You'll make inquiries about the tools available for thorough estate plans that can be customized to your distinct scenario. Their certifications for exercising estate planning, their experience with unique research jobs associated with your specific task, and exactly how they structure their settlement designs, so you have correct expectations from the beginning.

Little Known Facts About Estate Planning Attorney.

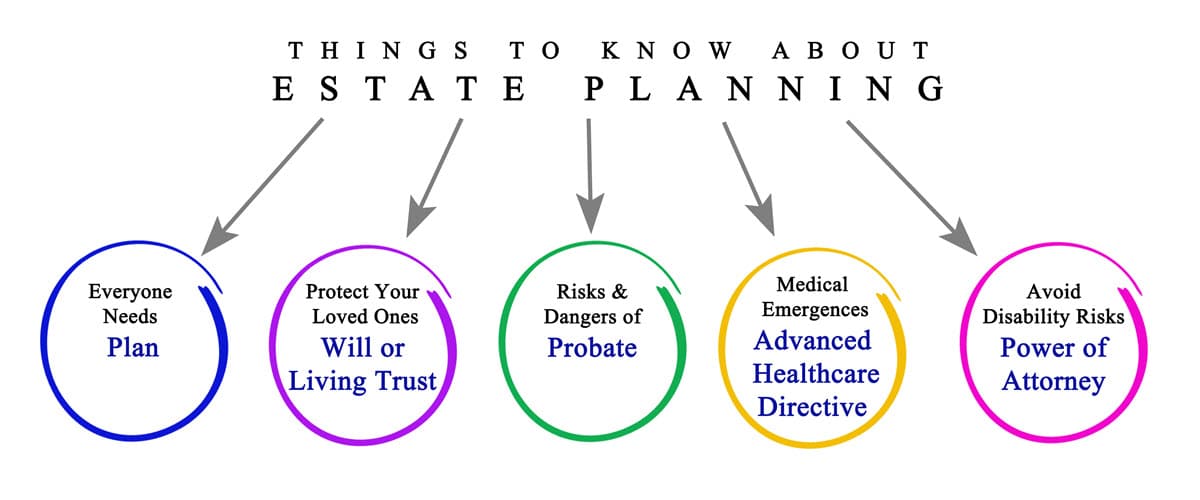

It is necessary to note that estate planning papers are not simply for rich people; everyone should think about having at least a standard estate strategy in area. With this being claimed, it's vital to comprehend what duties an estate preparation lawyer has to make sure that you can find one who meets your unique needs and goals.

This involves helping the client identify their assets and liabilities and their wishes regarding the circulation of those properties upon fatality or incapacitation. The estate planning attorney will certainly evaluate any current files that the customer may have in place, such as wills, trusts, and powers of attorney, to ensure they are up-to-date with state regulations.

Furthermore, the estate planning lawyer will certainly deal with the client to examine their tax circumstance and recommend methods for decreasing tax obligations while additionally attaining the desired goals of the estate strategy. An estate preparation attorney should be gotten in touch with whenever there are any type of changes to a person's financial scenario or family members framework, such as marriage or separation - Estate Planning Attorney.

With all these obligations in mind, it is essential to recognize what certifications one need to search for when choosing an estate organizer. When selecting an estate planning legal representative, it is necessary to make sure that they are certified and experienced. Numerous estate preparation attorneys have actually years of specialized training in the field and experience dealing with customers on their estate plans.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Experience and experience are vital when choosing an estate planning lawyer, however there are various other factors to consider too. As an example, some attorneys may specialize in certain areas, such as elder regulation or business sequence preparation, while others may be a lot more generalists. It is check out here likewise crucial to consider the referrals given by the lawyer and any type of reviews they have obtained from previous clients.

This will certainly allow you to recognize their character and experience level and ask inquiries regarding their practice and technique to estate planning. By asking these inquiries in advance, you will certainly better understand just how each attorney would certainly handle your situation before committing to work with here are the findings them on your estate strategy. You have to ask the ideal inquiries when choosing an estate preparation attorney to make certain that they are the finest suitable for your needs.

When picking an estate planning attorney, it is vital to comprehend what kinds of services they use. Ask about check over here the attorney's details estate planning services and if they can develop a customized estate plan customized to your needs. Likewise, ask if they have experience developing living trust papers and various other estate planning instruments such as powers of lawyer or health care regulations.

Report this page